Leaseback Real Estate Morocco: Invest and Earn Secure Passive Income

Investment into leaseback real estate Morocco is becoming a popular option for high-net-worth people (HNWIs) entrepreneurs and investors who are looking for a secure cash flow that is not dependent on hands. expanding Moroccan real estate market.

This article will explain the way leaseback works in Morocco as well as its financial advantages and legal ramifications and how to determine the most desirable leaseback properties in the most sought-after cities in Morocco such as Marrakech, Casablanca, and Tangier.

What Is Leaseback Real Estate in Morocco?

A leaseback is an investment option where you buy an asset in real estate typically the form of a hotel, serviced residence or resort, and lease it to a management firm. In exchange, you get an income from rental that is either fixed or contingent on performance while the operator manages reservations, maintenance and occupancy.

This model provides:

-

Guaranteed rental income

-

A minimal involvement in day-today operations.

-

Tax effectiveness for foreign investors

-

Professional property management

Why Leaseback Real Estate in Morocco Is Trending

A Fast-Growing Tourism Economy

Morocco welcomed over 14 million visitors in 2023, according to the World Tourism Organization. With tourism steadily rebounding post-pandemic, demand for short-term rentals is rising across key destinations like Marrakech, Agadir, and Essaouira making leasebacks especially profitable.

Stability in Real Estate with Euro Peg

The Moroccan Dirham’s ties to the Euro provides stability to the currency. This is what makes leaseback real estate Morocco very appealing to European investors seeking a steady earnings with a predictable income in Euro terms.

Government-Backed Infrastructure Growth

From high-speed trains to tourist-oriented development zones The long-term strategy for infrastructure in Morocco favors leasebacks, especially in cities that are awash with tourists.

Where to Invest in Leaseback Real Estate Morocco

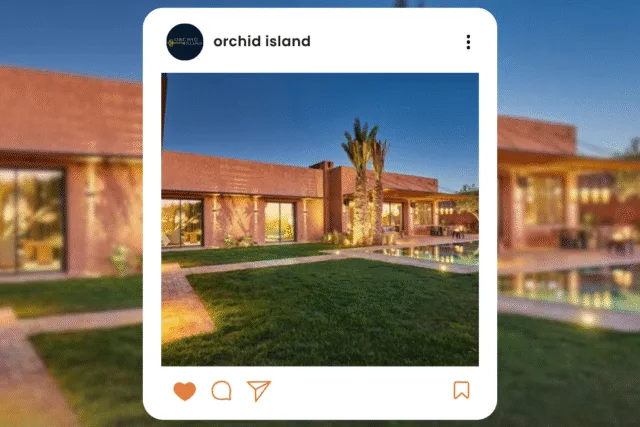

Marrakech: Cultural and Luxury Hub

Villas and leaseback apartments in the Palmeraie and Hivernage districts provide consistent rental yields because of the high-end tourism industry and all-year-round events.

Casablanca: Business Travel Capital

Serviced apartments close to the financial district and the newly constructed Marina are a perfect blend of leisure and business. Ideal for leasebacks of short-term stays.

Tangier: Rising Star in Northern Morocco

Tangier’s brand new port and technology investment zones are driving the demand for furnished homes in the mid-term, ideal for leaseback studios as well as beachfront flats.

Key Advantages of Leaseback Real Estate Morocco

Hassle-Free Ownership

The entire property management process, including cleaning marketing, communication with tenants are handled by experienced operators, usually with multi-year contracts.

Guaranteed Rental Returns

A number of developers provide an assured leaseback income (typically 4-8 percent net yield) for a period of 5 to 10 years. This provides security regardless of occupancy rates.

VAT Recovery & Tax Benefits

Foreign buyers can receive up to 20% VAT off newly constructed properties bought via leaseback schemes, which increases ROI by a significant amount.

Legal Framework and Due Diligence

Always Work With a Notaire

Legal representation through an attorney or Notaire is vital. They will ensure that the leaseback agreement is in compliance with Moroccan laws and protect your rights to freehold.

Key Contractual Clauses to Review

-

Lease agreement’s length

-

Rent income guarantee terms

-

Exit options and resale restrictions

-

Responsibilities for maintenance

Choose Titre Foncier Properties

Prioritize properties that have the registered title to land ( Titre Foncier) to ensure absolute ownership. Do not sign informal contracts or Melkia titles that are not legally valid for transfer.

What Kind of Properties Qualify for Leaseback?

-

Luxurious serviced apartments

-

Suites at hotels and residences with branded names

-

Resort villas close to golf courses, or the ocean

-

Boutique guesthouses in tourist districts

There are many developers who sell new build projects that come pre-packaged, including income and management contracts.

Potential returns From Leaseback Real Estate Morocco

Let’s consider one Marrakech example:

-

Purchase Price: EUR250,000

-

Rentback Yield 6% guaranteed

-

Annual Income: EUR15,000

-

Property Management Fees: Included

-

Expected Appreciation Over 5 Years: 20-25%

This makes leaseback among the most straightforward and clear options for buyers from abroad who want to enter the Moroccan luxury property market.

Who Should Consider Leaseback Property in Morocco?

-

HNWI seeking to diversify their portfolio across emerging markets

-

Entrepreneurs are focused on investments that do not require hands.

-

Expats and retired persons looking to purchase a home while in another country.

-

Yield-oriented investors seeking regular returns

If you’re looking for an income stream that is passive along with long-term growth and a minimal amount of operational stress leasingback is a great option.

What to Watch Out For

Overinflated Guarantees

Be wary of overly high returns and promises. Select reputable developers who have successful management partners.

Limited Personal Use Clauses

Some contracts limit the number of days you are allowed to use the property for yourself. Know this in advance before signing.

Non-Renewable Lease Terms

Find out about the ending-of-term scenario Do you have the option of renegotiating the lease? Sell the property for a profit? Or are you bound to selling it by the developer?

Case Study: Leaseback in Agadir

A French investor purchases an EUR200,000 studio at an oceanfront property managed by an French-Moroccan hospitality company. The property is leased for 7 years under a leaseback agreement with 5 % annual returns as well as three weeks of personal use each year.

-

Annual Net Income: EUR10,000

-

Operational Involvement: 0

-

Exit Strategies The strategy is to resell the product after 7 years, with a an estimated capital gain of 15-20%.

This kind of configuration is commonplace in Morocco’s city-center and coastal zones.

Conclusion: Leaseback Real Estate Morocco Is a Smart Strategy

Leaseback real property Morocco is a stylish investment option for those looking to earn both income and lifestyle. It’s the perfect choice for investors looking for certainty in their returns, legal clarity and access to Morocco’s luxurious market without the stress dealing with tenants.

Are you interested in exploring leasebacks with high yields within Marrakech, Casablanca, or the Moroccan coast?

Get in touch with Orchid Island Real Estate for curated listings that guarantee returns and full legal advice and a professional due diligence.

Leave a Reply